Soultions

Home

/

Soultions

/

Telecommunications

/

Voiceprint Recognition Solution

Voiceprint Recognition Solution

NSE NICE RTA Voiceprint Recognition - Case Study in Telecommunications Industry

Implementation of NSE NICE RTA Voiceprint Recognition - ROI

- Enhanced customer experience (CSAT +0.04)

- Improved operational efficiency & reduced AHT (Average Handle Time) call duration (average reduction of 13 seconds per call)

- Decreased & prevented fraud losses in customer service channels (Fraud Detection)

Implementation of NSE NICE RTA Voiceprint Recognition - Current Channels & Technologies

- Live customer service channels - Passive Enrollment (Text-independent)

- Live customer service channels - Passive Authentication/Verification (Text-independent)

- Live customer service channels - Blacklist Identification

NSE NICE 'Voice' ID - Enrollment

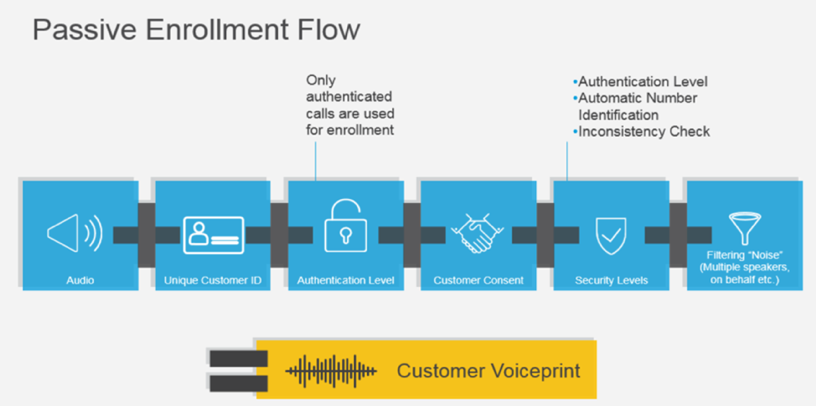

NSE NICE Real Time Authentication utilizes a 4-layer security model to ensure only legitimate customers can enroll, eliminating fraud attempts

- Proactive detection by customer service representatives, manually informing the system about the security and environmental conditions of the call (e.g., background noise or third-party speech).

- Automatic comparison with ANI (Automatic Number Identification) blacklist.

- Automatic comparison with voiceprints (Voice Biometrics) blacklist.

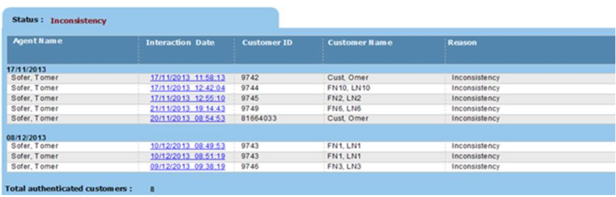

- Voiceprint consistency check (Inconsistency Check).

NSE NICE 'Voice' ID - 1:1 Identification

- NSE NICE Real Time Authentication supports Multiple Beneficiary verification, allowing verification for multiple entities such as companies or households. Each account can support up to 20 voiceprint IDs.

- Customer service representatives can activate Nanxun NICE RTA verification at any time to handle scenarios where customers request to switch agents.

- NSE NICE Voiceprint Verification UAT Accuracy: FAR (False Acceptance Rate) = 0.5% & FRR (False Rejection Rate) = 4.2%. This means, on average, for every 200 fraudsters attempting to access someone else's account, NICE RTA incorrectly allows access to 1 fraudster, and for every 24 legitimate users accessing their own accounts, NICE RTA incorrectly rejects 1 user.

NSE NICE 'Voice' ID - 1:N Identification

- NSE NICE RTA supports identification of blacklisted individuals based on voice and number, with proactive alerts sent to customer service and relevant supervisors.

- NSE NICE RTA Fraud Identification supports up to 5000 entries in the fraudster blacklist for backend registration checks, and up to 500 entries in the fraudster blacklist for real-time prevention during calls.

NSE NICE 'Voice' ID - Customer Future Planning & Backend Reports

- NSE NICE RTA enables customers to directly use their voiceprints for verification on other self-service channels like IVR and mobile applications, eliminating the need for separate registration.

- NSE NICE RTA also supports Active Enrollment, where customers repeat the same phrase to create a text-dependent voiceprint. In self-service channels, NICE RTA supports both active and passive verification (active enrollment/verification is typically recommended for self-service channels).

- When an online customer claims an identity mismatch or the system detects them as a blacklisted user, NSE NICE RTA combines with NEVA RPA (Robotic Process Automation) to provide real-time guidance to customer service on handling high-risk scenarios effectively.

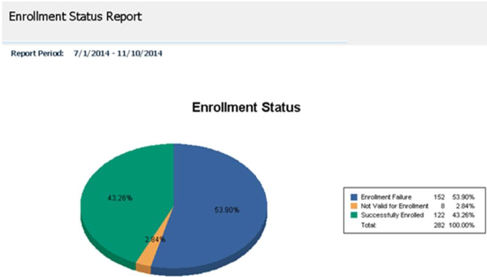

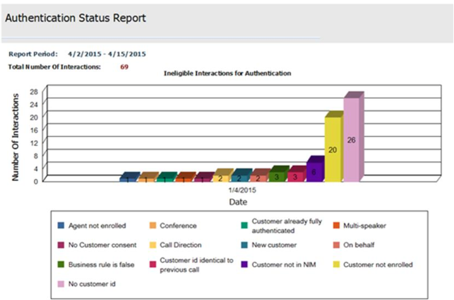

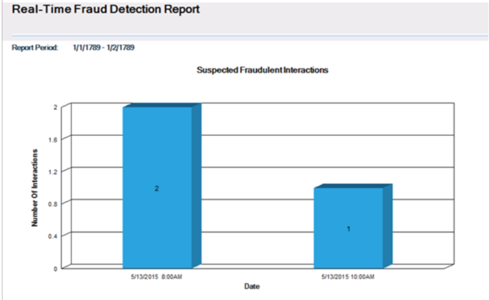

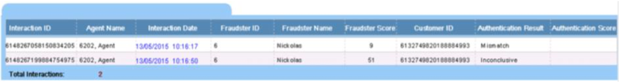

- NSE NICE RTA offers the Spotlight application and reporting feature, displaying system performance and providing continuous analysis of key performance indicators (KPIs) such as customer registration consent rate, registration success rate, verification success percentage, reasons for failed verification, blacklist calls, and more.

- Voiceprint Enrollment Status Report

- Voiceprint Verification Status Report

- Voiceprint Blacklist Detection Situation Report.

- Click here to learn more about NSE NICE RTA Intelligent Customer Service - Voiceprint Recognition Solution.

- Click here to learn more about NSE NICE RTA Voiceprint Recognition - Case Study in the Financial Industry.

- Click here to learn more about NSE NICE RPA Process Automation Robot Solution.

- Click here to learn more about NSE NICE RPA Process Automation Robot - Case Study in the Telecommunications Industry.

- Click here to learn more about NSE Genesys Cloud Omnichannel Cloud Intelligent Customer Service Solution.

- Click here to learn more about NSE Genesys Cloud Cloud Customer Service - Case Study in the Financial Industry.